WooCommerce VAT validation in Checkout Blocks often fails after switching from the classic checkout. This happens because Blocks use the Store API, so many traditional checkout validation hooks are not triggered. The result? Customers can submit incomplete or invalid VAT details, increasing billing errors and compliance risk.

Why VAT validation doesn’t work in WooCommerce Checkout Blocks

WooCommerce Checkout Blocks are built on the Store API. Many plugins (and custom snippets) validate VAT using classic checkout actions like woocommerce_checkout_process, but those are not always executed by the Store API flow. That’s why VAT checks that worked in the classic checkout may stop working when Blocks are enabled.

Classic checkout vs Checkout Blocks: the key difference

- Classic checkout usually validates fields through PHP hooks executed during form submission.

- Checkout Blocks validate through Store API endpoints and REST validation layers.

- If your validation does not run in the Store API, VAT rules are effectively bypassed.

How to properly validate VAT numbers in Checkout Blocks

A correct Blocks-compatible VAT validation setup should:

- Validate server-side via Store API validation (not only front-end).

- Handle EU VAT formats cleanly and avoid blocking checkout when external services are unreachable.

- Optionally validate EU VAT numbers through VIES (European Commission) with a safe fallback.

A Blocks-ready solution with optional VIES validation

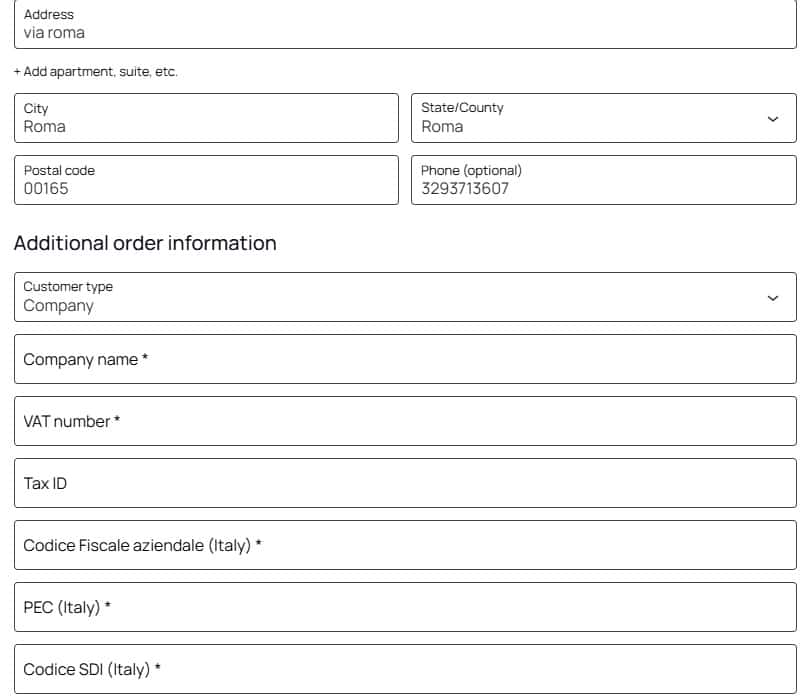

If you need a reliable solution that works with WooCommerce Blocks checkout and the classic checkout, you can use GG VAT Checkout Plugin for WooCommerce. It adds VAT / Tax ID fields and validates data server-side in the Store API flow, with optional VIES validation for EU VAT numbers.

FAQ

Will VIES downtime block checkout?

A robust implementation should not block checkout if VIES is temporarily unavailable. It should fail gracefully and allow the order to proceed.

Do I need VAT validation if I sell B2C?

If you sell B2C only, VAT validation may be optional. If you sell B2B across the EU, VAT validation becomes much more relevant for invoicing and tax compliance.