Sale!

WooCommerce VAT & Tax ID Checkout Plugin (EU Compliant – Vies Validation )

Original price was: 69,90€.49,90€Current price is: 49,90€.

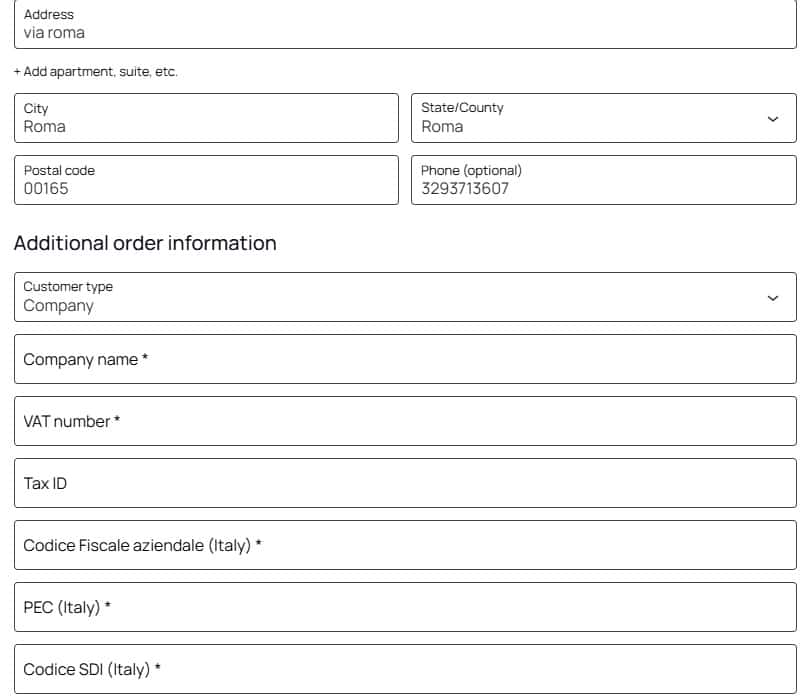

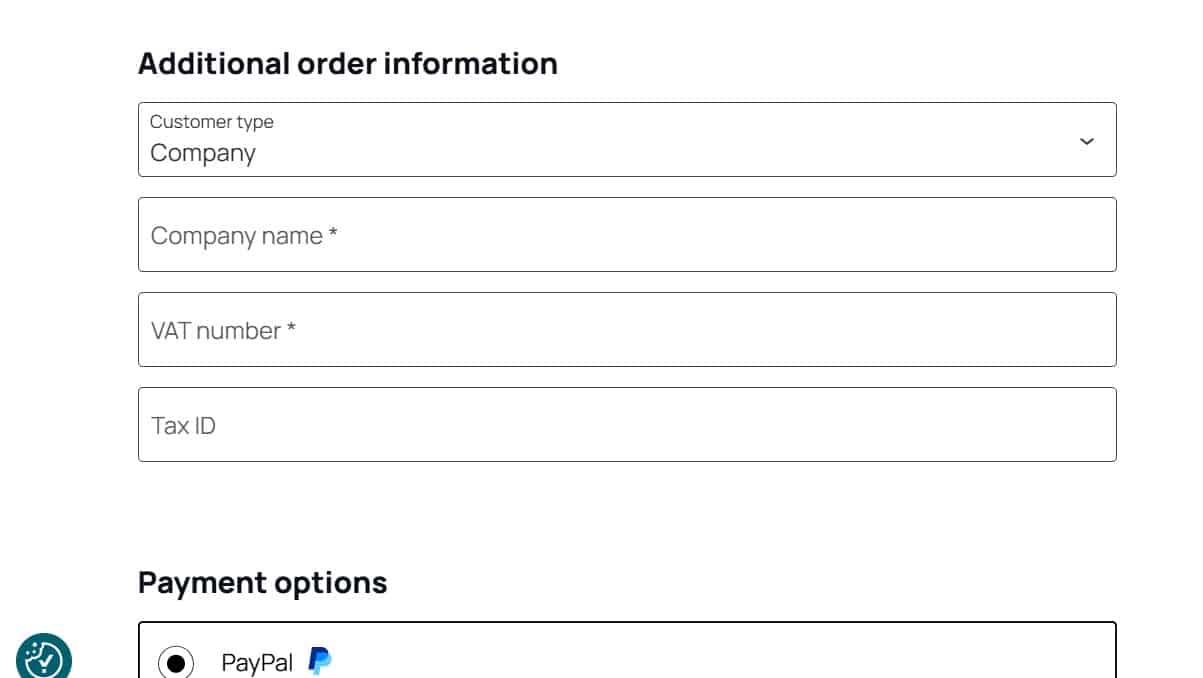

GG Checkout International adapts VAT / Tax ID / Italian fields based on: customer type (individual / company), the billing country, and your visibility / required settings.

1. Country-based logic

EU customers: VAT number can be required depending on your settings.

Non-EU customers: Tax ID can be required depending on your settings.

Italy (IT): Italian-specific fields (Codice Fiscale, PEC, SDI) are treated as Italian-only fields.

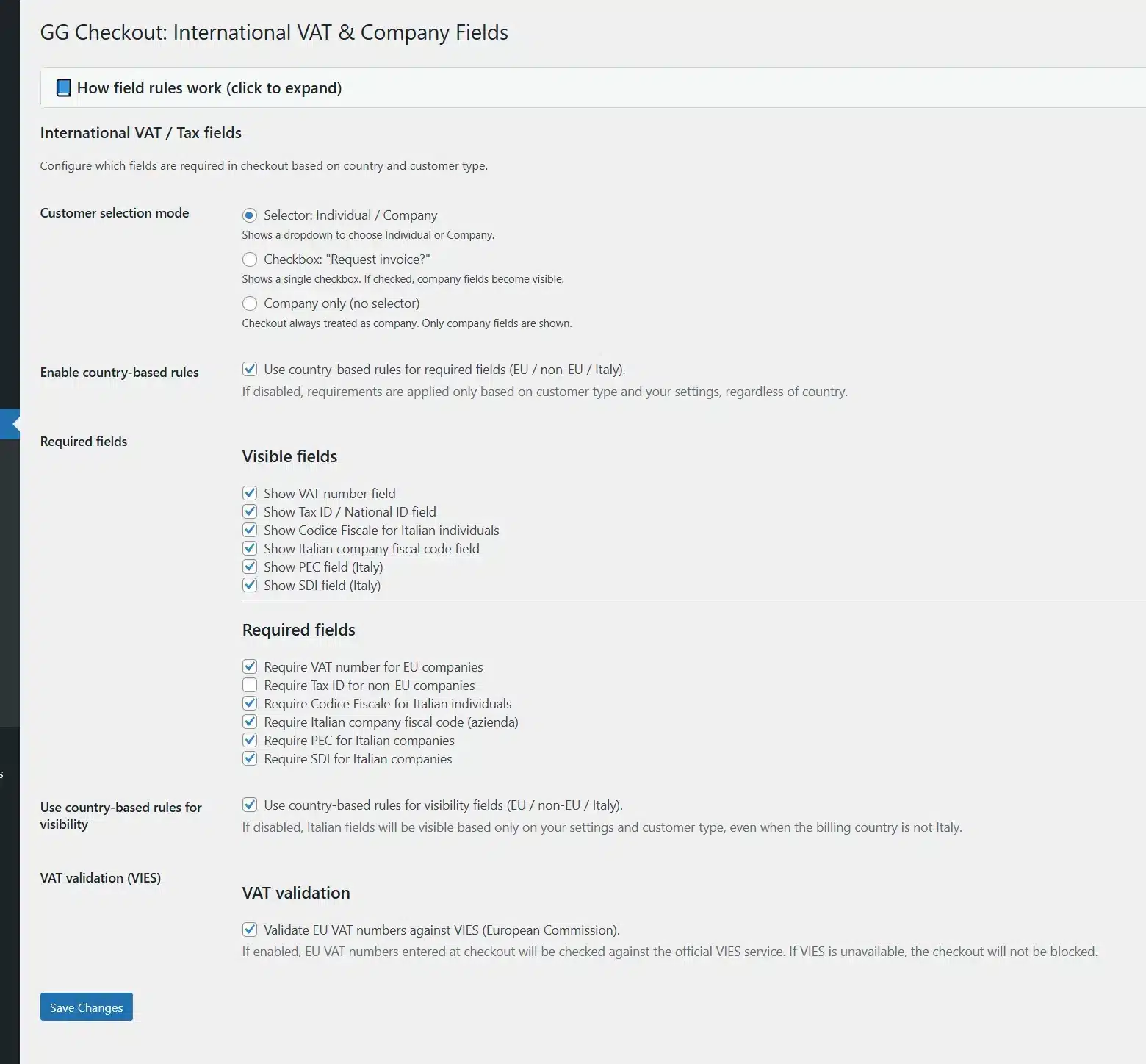

2. Country-based rules for required fields

Setting: “Use country-based rules for required fields (EU / non-EU / Italy).”

- Enabled:

- VAT → required only for EU companies (if the checkbox is active).

- Tax ID → required only for non-EU companies (if the checkbox is active).

- Italian rules (Codice Fiscale, PEC, SDI) → required only when billing country = IT.

- Disabled:

- VAT / Tax ID become required for <strong>all companies based on your checkboxes, regardless of EU / non-EU.

- Italian rules remain tied to Italy (required only if billing country = IT).

3. Country-based rules for visibility of Italian fields

Setting: “Use country-based rules for visibility fields (EU / non-EU / Italy).”

- Enabled (default):

- Italian fields (Codice Fiscale, PEC, SDI) are shown only when billing country = IT.

- Disabled:

- Italian fields follow only your “Visible fields” checkboxes and the customer type (they can appear even when the country is not Italy).

- However, validation still requires them only for Italian customers (billing country = IT).

4. Visibility vs Required

- Visible field = the customer can see and fill the field.

- Required field = the customer must fill it: this happens only when:

- the field is visible,

- the corresponding “Require …” option is enabled,

- and the country rule (EU / non-EU / Italy) matches.

✅ Works out of the box

✅ 1 year updates + support

✅ 14-day refund

Frequently bought together